When dealing with an insurance claim, you might wonder, “What does an adjuster do?” An adjuster plays a vital role in the claims process by assessing your policy and coverage, investigating the details of your case, and determining the value of your claim.

Their job is to ensure the process runs smoothly and fairly, helping resolve your claim efficiently.

- Confirm the policy and coverage.

- Investigate the facts, liability and damages of a claim.

- Evaluate the claim.

- Reserve the appropriate amount of money.

- Pay your claim and close the file.

Understanding What An Insurance Claim Adjuster Does

When you start a claim with an insurance company, you will be assigned a claims adjuster. An adjuster, also known as an insurance adjuster or claims adjuster, is a professional responsible for investigating and evaluating insurance claims to determine the extent of the insurance company’s liability.

Adjusters are different from insurance agents. Agents sell and maintain your policy but do not handle your claim.

The most common adjuster that you might be involved in would be a car insurance adjuster after getting into a car accident. Be sure to contact your insurance company to speak to an adjuster and bypass your agent to save yourself the extra step.

Types of Insurance Adjusters

There are three types of adjusters that you may be in communication with when filing a claim. You may be working with an adjuster directly for the insurance company, an independent adjuster, or lastly, a third-party administrator adjuster (TPA).

The claims adjuster may work for the insurance company or be an independent or third-party administrator adjuster (TPA). The latter two types of adjusters are simply names for outsourced adjusters. Outsourced adjusters are normally used on smaller claims and will only have limited authority (the top end of the range of money they can offer on any one claim).

Ask the adjuster if he works for the insurance company or if he is a TPA. While it doesn’t make any difference to your claim, with the exception being a TPA may need to get more authority to handle your claim, it will show him that you are knowledgeable of the system.

How Does Insurance Assign a Claim Adjuster?

Caseload, experience, and financial exposure are some of the factors insurance companies use to assign an adjuster.

- Case load is the number of cases an adjuster is currently handling. There is only so much time each adjuster has and each will most likely have the maximum quantity of cases.

- Adjuster experience comes into play when your claim is more complex. The more seasoned adjusters have worked through complicated liability or damages claims before so a claims manager will put such claims with them.

- Finally, there is financial exposure. Each adjuster has an authority limit. Authority is the maximum amount of money he is allowed to offer on a claim. New adjusters will be given very little authority, something like $5,000. All cases going to this adjuster are going to be estimated by the claims department at under this authority amount.

Something we see quite a bit is your claim getting transferred to another adjuster in the middle of the claims process. Once the insurance company sees that the claim may exceed their initial estimate, they will need to transfer it to an adjuster with more authority.

Another common time claims are transferred is when a claimant (that’s you) hires an attorney. A claim will almost never stay with the same adjuster once our Peachtree Corners personal injury lawyer steps into the picture. That is because it normally takes a differently trained adjuster to deal with an attorney.

Tips for Working With Insurance Adjusters

Understand How Insurance Companies Evaluate Adjusters

Insurance companies monitor their adjusters based on factors like monthly settlement amounts, the number of claims closed, and how many cases are resolved without involving attorneys.

You might consider asking the adjuster how their performance is evaluated early in the claims process. Understanding their job performance concerns could give you an edge in negotiations by framing arguments that align with their priorities.

You may want to play dumb with the adjuster at the beginning of the claims process by asking him how his performance is monitored. Understanding what the adjuster’s day-to-day concerns about his job performance are could help you in negotiating down the road by giving you an argument that appeals to his overall performance concerns.

Understanding the Adjuster’s Role

Remember, in the claimant-adjuster relationship, the adjuster holds the power. They control the funds and are not personally impacted if the claim goes into litigation. This allows them to take their time, assess how eager you are for a quick settlement, and evaluate your knowledge of the claims process.

Build a Positive Relationship with Your Adjuster

Adjusters are often overworked because insurance companies see claims and the adjusters managing them as expenses rather than profit-generating opportunities. To save money, companies frequently reduce the number of adjusters and increase the workload for those remaining.

It’s not uncommon for car accident claims adjusters to manage over 300 open cases at once, making it challenging to keep track of the details for each claim. Adjusters may also handle upwards of 50 incoming calls daily while making an additional 50 outbound calls, further adding to their burden.

Knowing How Your Claim is Tracked

In today’s digital claims process, everything is managed online, and your claim is stored in a computerized system. Adjusters maintain journals or diaries within your file to document their working notes, including what they know about the case, their conclusions, and details of any conversations.

When an adjuster asks for your claim number, it’s so they can quickly access your file and review these notes to refresh their memory before speaking with you. Remember, you will always know more about your claim than the adjuster.

They typically focus only on a few key aspects of your claim, such as:

- Special damages, like medical expenses and lost wages

- The length of your medical treatment

- The severity of your injuries

- The extent of property damage, such as damage to your car

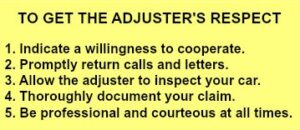

Be the Ideal Claimant for Your Adjuster

The more organized you are and the better you document your case, the more likely the adjuster is to respect your claim and how you are handling the process. Adjusters often deal with emotional and disorganized claimants, which can make their job more challenging.

By hiring our personal injury lawyer in Lawrenceville you will be well-prepared and professional, you can set yourself apart and leverage the principle of reciprocity to your advantage. When you provide clear, thorough documentation, you make the adjuster’s job easier, which can foster a more positive interaction and potentially benefit your claim.

Prioritizing Facts Over Emotions in When Dealing With Your Adjuster

The most important rule in dealing with adjusters is to act calmly and professionally. That can be hard to do. For you, the accident can bring up all kinds of emotions. For the adjuster, this is a business transaction. That is the way you need to treat it as well to get the maximum settlement.

The facts are the facts. To the adjuster, you claim is about the data of your claim – special damages, length of treatment, etc. You need to focus on the numbers and organizing them and their supporting documents to achieve a good settlement.

Staying on Top of Your Claim

You should take notes anytime you talk to an adjuster. If you discuss something important, or one of you promises to do something, follow up the call with a confirming letter.

If an adjuster promises to do something on your claim by a certain date, always send a confirming letter re-stating what he/she promised to do and the date it would be completed by.

When an adjuster says he/she will do or have something by a certain date for you, give the adjuster 2 days after the promised deadline and then call back.

But don’t pester the adjuster. You simply want to send the message you are staying on top of your claim and trying to keep it moving forward. Nagging will make the adjuster resent you and not want to extend the full authority on your claim.

Additional reading: Does it matter if you talk to your insurance agent

How Adjuster Authority Can Impact Settlement Offers

Depending on adjusters’ experience and skills, they will have a certain level of “authority.” Authority is the dollar limit of a case’s value they are allowed to handle. For example, assume adjusters have the authority to handle cases up to $15,000.

Suppose they reserve your case at $12,000 and later in the claims process the case value jumps up to $19,000. Your case is now above their authority and your file must get transferred to other adjusters or they need to go to their manager to get additional authority.

This may be the reason adjusters are fighting from increasing their offer – they don’t want to deal with having the file transferred or having to go to their boss to ask for an increase.

This can be a powerful motivator for adjusters to cram the settlement down under their authority. If you think this is happening, respectfully ask what their authority is. Ask if they are not increasing their offer because they are fighting to keep the case under their authority level.

When Not to Talk to an Adjuster

There are times when speaking to an insurance adjuster can work against you, especially if the adjuster represents the at-fault driver’s insurance company. They may use your statements to minimize or deny your claim.

If you’re unsure about what to say or feel pressured, it’s often best to avoid direct communication until you’ve consulted with our attorney.

For more detailed advice on this topic, visit our Why Not to Talk to Insurance Adjusters for At-Fault Drivers page.

How a Lawyer Can Maximize Your Insurance Settlement

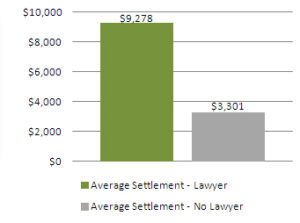

A 2008 Insurance Research Council study shows people with lawyers handling their claim get a whopping 181% more than if they were to handle it themselves! Yes, we do work on contingency, meaning our fee is 33% (standard fee) of the settlement we get for you, but you’ll see in this scenario, you’d still be ahead. Just look at the numbers:

$9,278 average settlement with a lawyer

-$3,062 contingency fee of 33%

$6,216 settlement to you with a lawyer

Compare this to $3,301, which is the average settlement without a lawyer. That’s $2,915 MORE you would receive with a lawyer! The numbers speak for themselves. Keep in mind, however, that this is an average, and your accident may not be severe enough to warrant an average settlement.

For more insights into settlement amounts, check out our article on the average car accident settlement.

We Are Here for You

Imagine having a personal concierge for your legal needs. Our firm is here to alleviate the stress, time, and frustration associated with personal injury claims.

Our Duluth personal injury lawyer offers free, no-obligation consultations to discuss your specific situation and determine the best course of action. Call us today at 404-809-3240 to get started.

FAQs

How do adjusters determine damage?

Adjusters assess damage byreviewing repair estimates, inspecting the vehicle, and considering any photos or documentation provided. They may also consult repair shops or use software tools to estimate costs, ensuring the claim aligns with the policy’s coverage.

What happens after an adjuster looks at your car?

After inspecting your car, the adjuster calculates the repair costs or determines if the vehicle is a total loss. They’ll then share their findings with you and the insurance company, outlining the next steps for processing your claim or issuing a settlement.

What can I expect from an insurance adjuster?

You can expect an insurance adjuster toinvestigate the claim, verify policy coverage, and evaluate damages. They aim to settle the claim efficiently while keeping costs in check, but their priority is to represent the insurance company’s interests.